Introduction

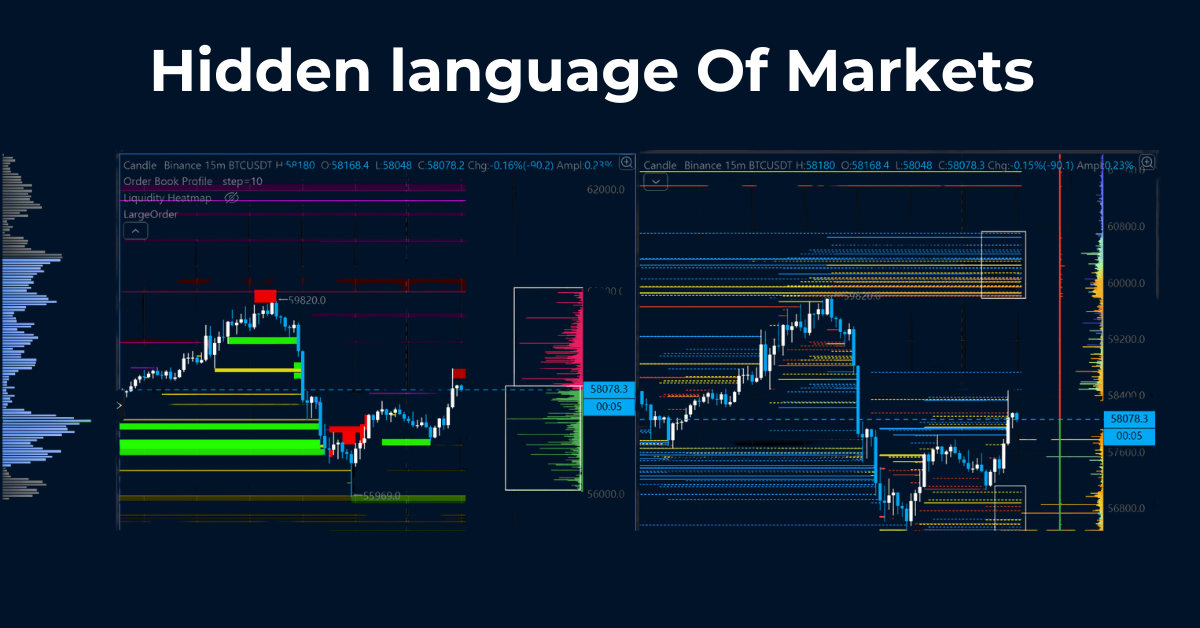

Most traders rely on indicators that lag behind price action. But Orderflow Trading gives you something more powerful — the ability to read real-time market transactions between buyers and sellers.

What is Orderflow?

Orderflow is the analysis of executed buy and sell orders within the market. It shows you who is in control — the buyers or the sellers — by analyzing volume traded at bid and ask levels.

Why It Matters

Unlike indicators, orderflow doesn’t predict — it shows the truth happening now. You can see absorption, exhaustion, trapped traders, and liquidity grabs before the candle even closes.

How Professionals Use It

Institutional traders use orderflow to confirm entries around key zones — VWAP, Value Areas, and previous day highs/lows — ensuring they enter with the real momentum, not against it.

Final Thoughts

Mastering orderflow transforms your trading. If you want to learn how to combine orderflow with volume profile and AMT, explore Spartans Clan — where real traders evolve.